How to Interpret Federal Reserve Announcements for Stock Trading?

Author: sana

Have you ever felt you're decoding a secret language when the Federal Reserve speaks? You're not alone. For many stock traders, these announcements can be a real head-scratcher.

Misreading the Fed's signals is challenging and can cost you a lot of time in the market. One wrong move based on a misunderstood statement could seriously damage your portfolio.

But don't sweat it. We're here to help you crack the code.

This guide will walk you through the ins and outs of Federal Reserve announcements. By the time you're done reading, you'll be able to cut through the jargon and get to the heart of what matters for your trades.

Ready to turn those confusing Fed statements into your secret weapon for more brilliant stock moves? Let's get started!

Why Do Fed Announcements Matter for Your Trades?

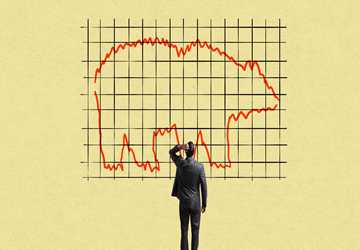

The Federal Reserve pulls many strings in the financial world. Their words can make the market dance or stumble.

When the Fed talks about interest rates, it's not just banker babble. It affects everything from your mortgage to big company loans. Lower rates? Stocks might party. Higher rates? The market could get jittery.

Inflation chatter from the Fed isn't just economic trivia. It shapes how much your dollar is worth and can sway entire market sectors.

And don't underestimate the power of Fed vibes. Their economic outlook can spark traders' buying frenzy or a selling panic.

Smart traders listen to Fed news. It's not about predicting the future—it's about being ready to ride the market waves the Fed creates.

Cracking the Fed Code: What to Watch For

Let's roll up our sleeves and dig into the meat of Fed announcements. These aren't just dull press releases – they're packed with clues that can shake up your trading game. We'll break down the big three things you need to keep an eye on.

1. Interest Rate Decisions: The Market's Puppet Strings

When the Fed fiddles with interest rates, the whole market feels it.

A rate hike? That's the Fed pumping the brakes on the economy. It could make borrowing pricier and cool off stock prices.

Conversely, a rate cut is like the Fed hitting the gas. It might juice up the economy and give stocks a boost. But here's the kicker – sometimes the market's already guessed what the Fed will do. So keep your eyes peeled for surprises.

Watch how different sectors react. Banks might grin at higher rates, while real estate could wince.

Tech stocks? They're often sensitive to these shifts, too. Smart traders don't just note the change – they think about who wins and who loses when rates move.

2. Economic Projections: The Fed's Crystal Ball

The Fed isn't just reacting to today; it's planning for tomorrow. Its economic projections are like a sneak peek into its playbook.

GDP forecasts can hint at whether the Fed sees smooth sailing or choppy waters ahead. An optimistic outlook might signal more rate hikes to keep the economy from overheating. Pessimistic? They might be prepping to cut rates.

Inflation projections are another goldmine. If the Fed worries about rising prices, it might tighten the money supply, which could pressure growth stocks.

Employment forecasts matter, too. A rosy job market might encourage the Fed to be more aggressive with rate hikes. If there is trouble in the job market, the Fed might ease up to avoid choking off growth.

Savvy traders use these projections to get ahead of the curve. It's not about taking the Fed's word as gospel; it's about understanding their mindset and planning your moves accordingly.

3. Policy Statements: Reading Between the Lines

The Fed's policy statements are where the real detective work begins. It's not just what they say – it's how they say it.

Keep an eye out for changes in language from previous statements. Shifting from "patient" to "vigilant" could signal a more hawkish stance. "Transitory" inflation becoming "persistent"? That might mean tighter policy ahead.

The statement often hints at future moves. Phrases like "prepared to adjust" or "closely monitoring" are Fed-speak for "we might make a move soon." These subtle cues can help you position your portfolio before the crowd catches on.

Don't ignore the dissenting voices, either. If some Fed members disagree with the majority, it could signal uncertainty or future policy shifts. This insight can give you an edge in predicting the Fed's next move.

Remember, trading on Fed statements isn't about knee-jerk reactions. It's about piecing together the puzzle and making informed decisions. The more you practice reading these statements, the better you'll get at spotting the real market movers.

Playing the Fed Game: Smart Moves for Savvy Traders

Don't just sit there when the Fed drops its bombshells; be ready to move. But hold your horses – knee-jerk reactions can backfire.

First, take a breath and digest the news. Compare it to what the market expected. Surprises are where the real action happens.

Do you have some time-sensitive positions? Consider trimming or hedging if the Fed's tone doesn't match your bets. But don't overhaul your entire strategy in one announcement.

For the Long Term, Use Fed insights to fine-tune your sector allocations. With rate hikes coming, ease up on growth stocks and look at value plays.

Stay in the loop with Fed-watching tools like economic calendars and live Fed commentary. But remember, the Fed's just one piece of the puzzle. Always blend their take with your market research.

Smart traders don't fight the Fed; they surf its waves. Keep your eyes open, your mind sharp, and your strategy flexible.

Time to Put Your Fed-Savvy to Work

You've got the inside scoop on Fed-speak now. Don't let it go to waste. Start tuning into those announcements like a pro.

Keep a trading journal and note how the market reacts to different Fed moves. Over time, you'll spot patterns the average Joe misses.

Remember, knowledge is power in trading. Stay hungry for information—follow Fed members on social media, read economic reports, and never stop learning. The market's constantly changing, and so should your strategies.

Ready to level up your trading game? The Fed's following announcement is your chance to shine. Get them, trader.

Frequently Asked Questions

Q: How often does the Fed make announcements?

Ans: The Fed meets eight times a year, roughly every six weeks. But they can make surprise announcements if the economy takes a sudden turn.

Q: Can I predict what the Fed will say?

Ans: Not with certainty, but you can make educated guesses. Watch economic indicators and listen to Fed members' speeches for clues about their thinking.

Q: Should I trade immediately after a Fed announcement?

Ans: Careful there, tiger. Markets can be volatile right after announcements. Wait for the dust to settle unless you're comfortable with high-risk trades.

Q: What if I misinterpret a Fed announcement?

Ans: It happens to the best of us. Always use stop-losses, and don't bet the farm on one interpretation. Diversify your strategies to cushion potential misreads.